Learn Center

Finance for Crypto

What Is Hyperinflation? How Does It Impact the Economy?

What Is Hyperinflation? How Does It Impact the Economy?

When hyperinflation strikes, the value of government cash becomes so worthless that some families might use their paper currency for crafts or to light fires. Essentials such as groceries and gasoline may require wheelbarrows worth of cash to buy.

Although every economist acknowledges hyperinflation is devastating, not everyone agrees on how to combat it. Once hyperinflation starts, it's exceptionally challenging for central banks and governments to contain or reverse it, which is why they prioritize preventing it in the first place.

As more nations struggle with rising prices, especially following the COVID-19 pandemic, it’s important to review what hyperinflation is and how it could affect the global economy.

What does hyperinflation mean?

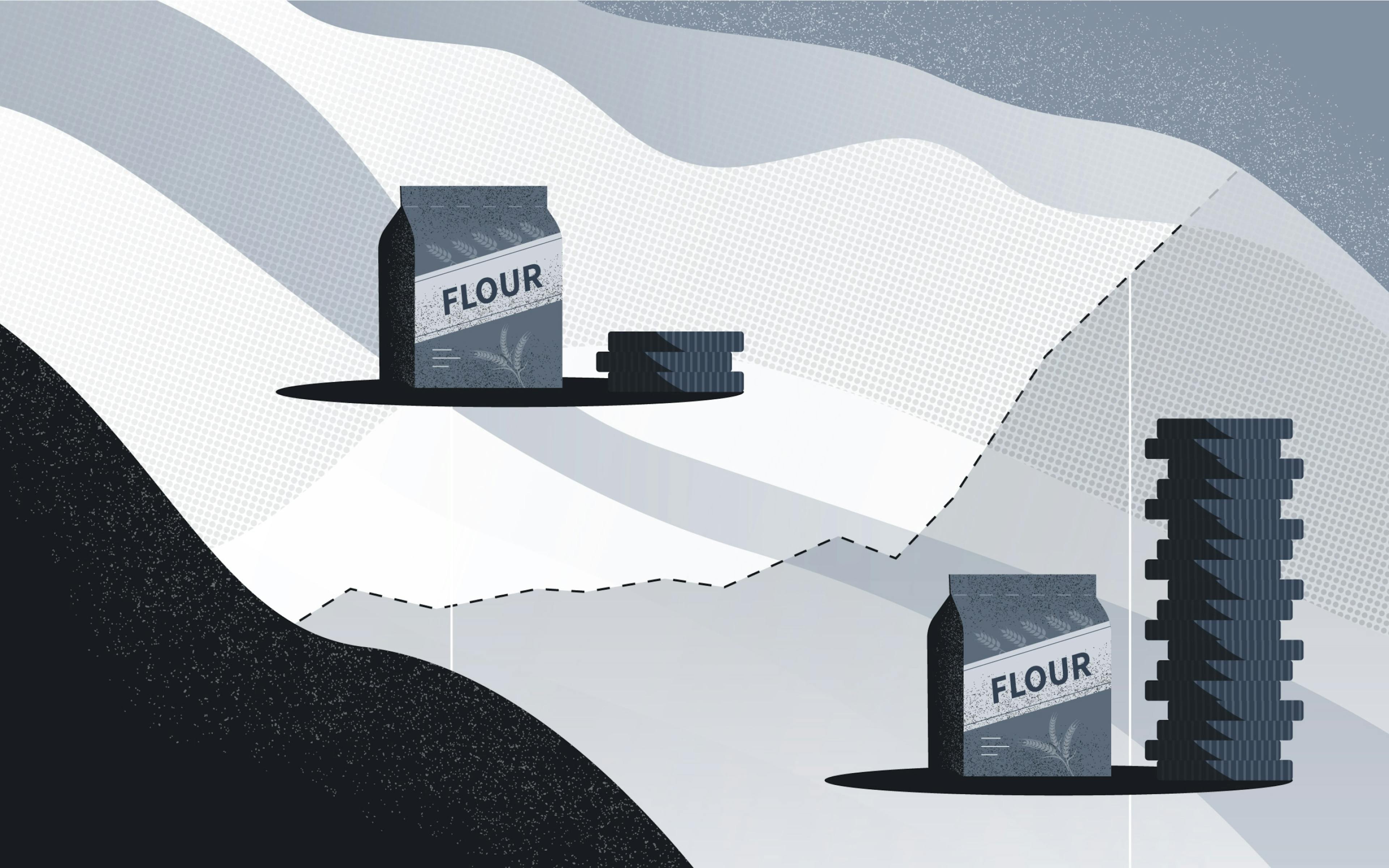

Hyperinflation refers to a sharp increase in a country's money supply, which leads to order of magnitude increases in average prices for goods and services. The more currency enters a country's economy, the less valuable each unit becomes. This devaluation of fiat currency forces manufacturers and businesses to raise prices, often leading to a vicious hyperinflationary spiral.

While hyperinflation and inflation involve the same currency devaluation process, the former has more catastrophic economic effects. Most economists define hyperinflation as a monthly inflation rate of more than 50%. Contextually, many central banks in industrialized nations strive to maintain a "healthy" inflation rate of 2% per month.

Some financial analysts even use the terms "hyperinflation" and "superinflation" interchangeably.

What causes hyperinflation?

Hyperinflation always occurs when too much money enters a nation's circulating supply. However, more factors contribute to hyperinflation.

- Large government debt burdens: If governments take on too much debt, they may print more paper money to meet their obligations. The more money enters circulation, the greater the odds of inflation or hyperinflation.

- Geopolitical conflicts or national instability: It's most common for hyperinflation to happen during extreme stress and conflict. This is when governments are more prone to print extra money to respond to serious security risks. Major health emergencies, such as the pandemic, can trigger more money printing, resulting in hyperinflation.

- Excessive demand: The "demand-pull theory" argues that inflation results from increasing demand and decreasing supply. When there aren't enough goods to meet the heightened demand, prices will rise.

- Wage-price spiral: The wage-price spiral refers to a situation where employers constantly increase the minimum wage for their employees. According to this theory, as manufacturers spend more on their workers, they increase the costs of goods and services. The higher cost of living forces employees to demand more wages, which further drives the costs of goods. The wage-price spiral is also called the "cost-push theory" of inflation.

What happens during hyperinflation?

Here are some of the most common consequences:

- Drastic rise in prices: Hyperinflation makes it impossible for everyone to "make ends meet." The prices of essential items rise so high and fast that most families can't afford necessities. Even after wage increases, it's impossible to maintain the same standard of living. More people may hoard food, medicine, and gasoline in this stressful environment, triggering supply shortages and limiting economic growth.

- Financial stress: Any money held in savings accounts becomes virtually worthless, and investments such as stocks likely fall in value. Banks may also lose capital, especially as more clients withdraw as much as possible.

- Political tension: The adverse effects of hyperinflation often lead to increased civil unrest. As more people lose faith in their currency, significant political change and revolution may occur.

Examples of hyperinflation

Some historians claim the Edict of Diocletian in Ancient Rome is a classic example of hyperinflation. While this is debatable, there are many clear examples of hyperinflation in more recent times.

- Post-Revolutionary France: The turmoil of the French Revolution, coupled with massive war debts, forced the French government to print high volumes of paper currency. This resulted in multiyear hyperinflation, further destabilizing 18th-century French society.

- Weimar Republic Germany: Following World War I, Germany suffered extreme hyperinflation in its "mark" fiat currency. A combination of excessive borrowing and high war reparations caused the mark to skyrocket by 700% in the mid-1920s.

- Zimbabwe: Due to high national debt, decline in economic output, and drop in export earnings, Zimbabwe began printing excessive amounts of paper currency in the early 2000s. By 2001, the inflation rate soared to more than 100% and continued to rise millions of percentage points in the succeeding years.

How to prepare for hyperinflation

Most nations have in-house central banks with special monetary and fiscal powers to minimize the risk of hyperinflation. For instance, the U.S. Federal Reserve can adjust bank interest rates and reserve requirements. It can also influence the money supply by buying or selling assets such as treasury bonds and mortgage-backed securities.

If central banks want to decrease inflation, they’ll likely dampen demand by increasing interest rates and bank reserve requirements. These higher borrowing rates tend to discourage spending. Theoretically, the less money that enters the circulating supply, the lower the inflation rate should be. However, there’s a risk that these policies could trigger other economic issues, such as a recession or depression.

Besides adjusting monetary policy, banks like the Fed actively monitor statistics such as the Consumer Price Index (CPI), gross domestic product (GDP), and unemployment. Fed officials regularly meet to discuss these statistics and ensure the inflation rate isn't soaring.

From an investment perspective, "store of value" assets and commodities tend to rise in price during hyperinflation. Precious metals such as gold and silver are often considered "safe haven" assets due to their scarce supply. Real estate prices also tend to at least retain their value in a hyperinflationary environment.

Can crypto help with hyperinflation?

A significant reason many believe cryptocurrencies like Bitcoin (BTC) have value is due to their scarce supply. In fact, Satoshi Nakamoto deliberately modeled Bitcoin on "inflation hedge" investments like gold. Once people mine all the 21 million bitcoins, the crypto will have an inflation rate of 0%. Crypto supporters believe Bitcoin's hard-cap supply can counter inflation and hyperinflation.

Besides Bitcoin, there are crypto projects with a deflationary issuance rate. Most notably, Ethereum (ETH) introduced a coin-burning mechanism called "EIP-1559" in 2021. A portion wipes out of existence whenever people use Ethereum's ether coin on the blockchain. Whenever this "burn rate" exceeds daily ETH issuance, ETH has a negative inflation rate.

Some nations struggling with inflation have already begun experimenting with using cryptocurrency as payment and investment. For instance, crypto adoption has risen in Argentina as the country's peso continues to post double-digit inflation rates. Recent surveys reveal at least 60% of Argentines believe Bitcoin will have a higher value in two years, while only 35% have the same faith in the Argentine peso.

Additionally, stablecoins provide an alternative to more volatile cryptocurrencies. People in a country with high inflation buy stablecoins such as USDC and Tether and get access to the U.S. levels of inflation. It’s a great way for them to store their value. Unfortunately, in countries with high inflation, it’s difficult to on-ramp into crypto.

Hard-cap supplies and deflationary mechanisms can protect against hyperinflation, but they can't guarantee cryptocurrencies will increase in value. Cryptos like Bitcoin and Ethereum still need wider adoption to serve as effective inflation hedges.

Wrapping up

Although hyperinflation is relatively rare, it's always a possibility. Once hyperinflation becomes a reality, the effects are devastating for local families and businesses. It's also difficult for governments to contain hyperinflation once they start printing large sums of money. However, as cryptocurrencies become more mainstream, they could provide a viable solution to rampant hyperinflation.

At Worldcoin, we aim to educate more people about the potential benefits of cryptocurrencies, such as Bitcoin, to combat hyperinflation. We intend to put a share of our crypto in everyone’s hands, encouraging them to experiment with digital assets. Subscribe to our YouTube channel to learn more.